Categories

Choose Language

Popular Posts

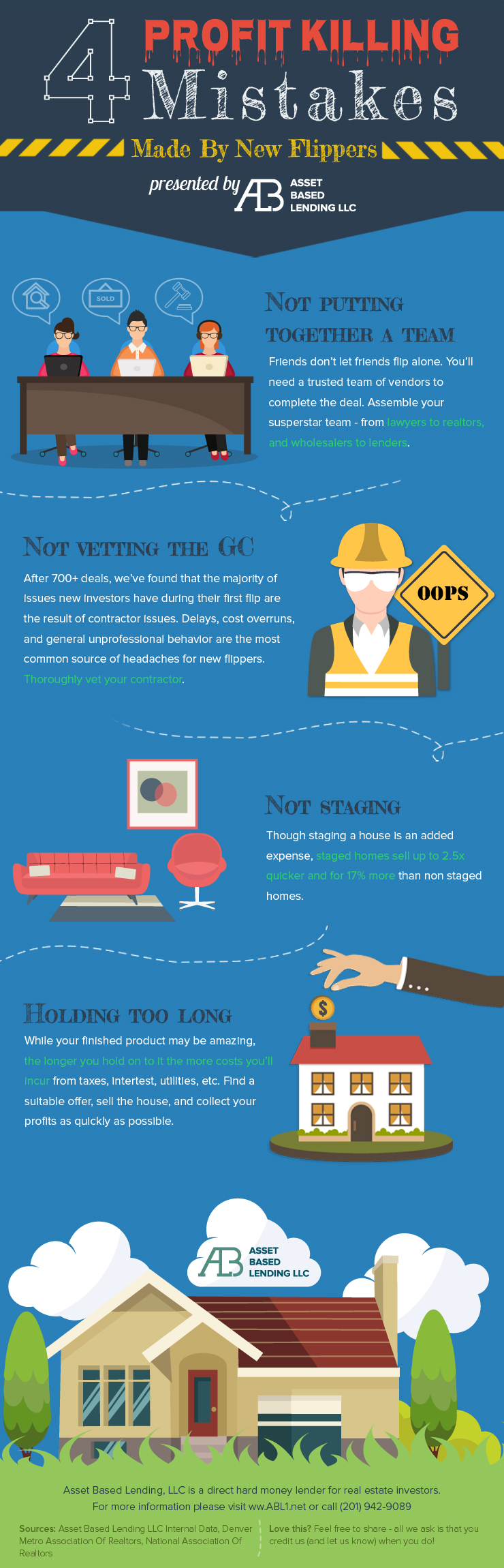

Four Profit-Killing Mistakes Made By New Home Flippers

Four Profit Killing Mistakes created by Asset Based Lending

Fix-and-flip TV shows make buying, rehabbing and selling a property look easy — until you undertake such a project yourself. If you’re new to home flipping and aren’t careful in your research, planning and execution, you may end up with no profit at all or even a significant loss. However, common mistakes and setbacks can be avoided with the proper preparation.

A common mistake that sabotages fix-and-flip projects is not sticking to a realistic budget. Keep your flip’s expenses in line and make sure you’ve budgeted all costs from demolition to final cleaning. The two biggest expenses will most likely be acquiring and rehabbing the house. Do your research and obtain bids from a few contractors for whom you have referrals and whose work you’ve seen firsthand.

Most importantly, prepare for things to go wrong during the course of the flip. Be well informed on potential home-rehab problems so you can work them into your budget if necessary. Unforeseen issues such as termite damage and the discovery of mold will be less distressing if you’ve added a line item for contingencies in your budget.

Not staging the finished flip is another common misstep that can quickly sabotage your profit. Potential home buyers can relate more easily to a staged house because it allows them to imagine themselves living in the space.

By investing a little money to stage your flip, you could earn a significant return. According to the Real Estate Staging Association, homes that are staged before going on the market sell 73 percent faster than nonstaged houses. Although hiring a professional service to stage your home may increase your out-of pocket-expenses, it’s a potentially lucrative investment.

Another profit-killing mistake inexperienced flippers tend to make is holding onto a property too long. If you acquired a fix-and-flip loan to fund your project, chances are you have a monthly payment.

The longer you carry the home, the more those mortgage expenses will accumulate, as well as soft costs such as taxes and utilities. Remember, the quicker you flip your property, the faster you’re able to re-invest your money in a new project. Creating a firm timeline for your project can help you stay on track.

Rehabbing a property can easily go from flip to flop. For more common profit-killing mistakes to avoid and positive steps that can position you for home-flipping success, see the accompanying infographic.

Author bio: Eric Krattenstein’s extensive marketing experience began at a boutique marketing agency where he developed dozens of successful innovative marketing strategies for brands ranging from startups to Fortune 500s. Prior to joining Asset Based Lending early in 2016, Eric served as the US Chief Marketing Officer for a European enterprise software company where he spearheaded the company’s expansion into the United States and Canadian markets. In his current role, Eric leads ABL’s Sales and Marketing team that helps upwards of 40 to 50 real estate investors close hard money loans each month.

Popular Posts:

Kaya Wittenburg

Kaya Wittenburg is the Founder and CEO of Sky Five Properties. Since the age of 10, real estate has been deeply ingrained into his thoughts. With world-class negotiation and deal-making skills, he brings a highly impactful presence into every transaction that he touches.

He is here to help you use real estate as a vehicle to develop your own personal empire and feel deeply satisfied along the way. If you have an interest in buying, selling or renting property in South Florida, contact Kaya today.