Categories

Choose Language

Popular Posts

[mashshare url="http://www.skyfiveproperties.com/blog/purchasing-property-abroad-5-simple-steps-secure-buying"]Purchasing Property Abroad – 5 Simple Steps To Secure Buying

When opting to purchase property abroad, for either personal or investing in a developing housing market, opportunity abounds. It’s likely this opportunity is the driving force for your interest abroad, or it may simply be your interest in that culture. Of course, purchasing property is a long-term investment, so it’s unlikely to be taken lightly. For this reason, it pays to know what you’re getting into. Not only are those firms you’re to interact with worthy of studying deeply, but it’s important to reflect into your reasons for choosing a particular market to invest in.

Like all investments, property can be risky. However, with a steadfast interest in gathering correct information and verifying the security of your trade, you’re going to sleep much better at night. There’s no reason why this decision won’t be successful, so long as you keep safety and sensibility in high regard.

Consider our five simple steps to secure buying abroad. This temperance of your own attitudes and a diligence in fact checking can help you make the best decisions possibly, hopefully leading you to a secure long-term return on investment:

Vet The Agency

When investing abroad, you’re likely going to encounter a holder of the property asset, perhaps a real estate firm, or even an investment firm or individual like you. Of course, there are a million different forms of collective that the property could belong to. You might be purchasing it from a static company, or even an individual who uses this as their home. What matters is that you choose to vet both the seller and the property agent through and through. Try to look online for information about past controversies perhaps, or basically anything that could influence the potential integrity of the investment.

Look through the contracts deeply, and ensure that every single asset stated within the bundle of the property sale is present and worthwhile. Of course, sending inspectors to both ensure the property is well maintained and represents the correct value suggested is imperative. Vetting the agency can potentially help you avoid a difficulty from cropping up.

Speaking To The Owner

It can be important to begin a social relationship of some kind with the person selling you this investment. This is most important if you’re purchasing a few properties, or a truly valuable asset. Having them show you around and conducting the lip services of standard business metering can help you enjoy the best and most confident level of purchasing. It can also lend you insight into the local area, a little into why they are selling, and potentially help you develop a relationship for future purchases. While property is stable and often a reliable investment, it’s always best to curate connections with a seller who may help you invest further in the future.

This can be especially useful when purchasing property abroad. The landscape can be a somewhat alien concept to you. With someone like this on your side, or at least someone to help you familiarize yourself with property law, you might enjoy an easier purchase. Although be sure to run all and any documents given to you through a local law firm you trust, as sometimes it can be easy to

Using Technology

Technology touches all manner of business these days, and investing in property is no different. When investing abroad, this can be a life saver, because verifying certain properties and deals can be done via blockchain. To get in-depth about why this is so useful, be sure to refer to this article about how blockchain is helping real estate investors make good on their investment, and minimize the risk. Put simply, blockchain can be utilized as a true means of securing the value of an investment, especially when investing or lending in quality mortgage-backed securities.

Familiarizing Yourself With The Market

It’s absolutely essential to familiarize yourself with the market before you invest in it, that much is obvious. But consider how the law works there in the complex variables you might consider relevant to your business function in future. For example, it might be that a tangled web of approval will need to take place if you’re to ever manage to expand on your properties through the art of renovation. This delay could cost you forecasted profits, or potentially nullify the renovation itself. Familiarizing yourself with the market is considered one of the most important considerations, because it can vary wildly from country to country. Sometimes, even council by council. Zoning laws may be very different, or have many different classifications. It might even be that the area you’re hoping to invest in has recently been declared an area of untouchable beauty, meaning that any work taking place there could be truly barred from taking place.

Do you hope to move to an office abroad, and this is the purchase hopefully precipitating your move? Have you checked to see if this space is even legally qualifiable as registering a place of business for? Of course, not every investment will be plagued with the issues we have brought up here. However, it is essential to consider how even one ill-researched or litigious web of error could prevent your plans from taking place.

Planning Projects

Before you even purchase the property, it might be worth dedicating the time to studying the floor plans, and figuring out what you hope to do with it. While heading abroad to research the property is essential, the costs involved with travel, planning, supplying and many other quirks of industry could take too long if you’re not prepared. Connect with suppliers in the area. Look for similar projects. Consider nearby developments and try to figure out what operational capacities they are working with. All of this can contribute to the planning of your project in the long term, giving you more room to grow.

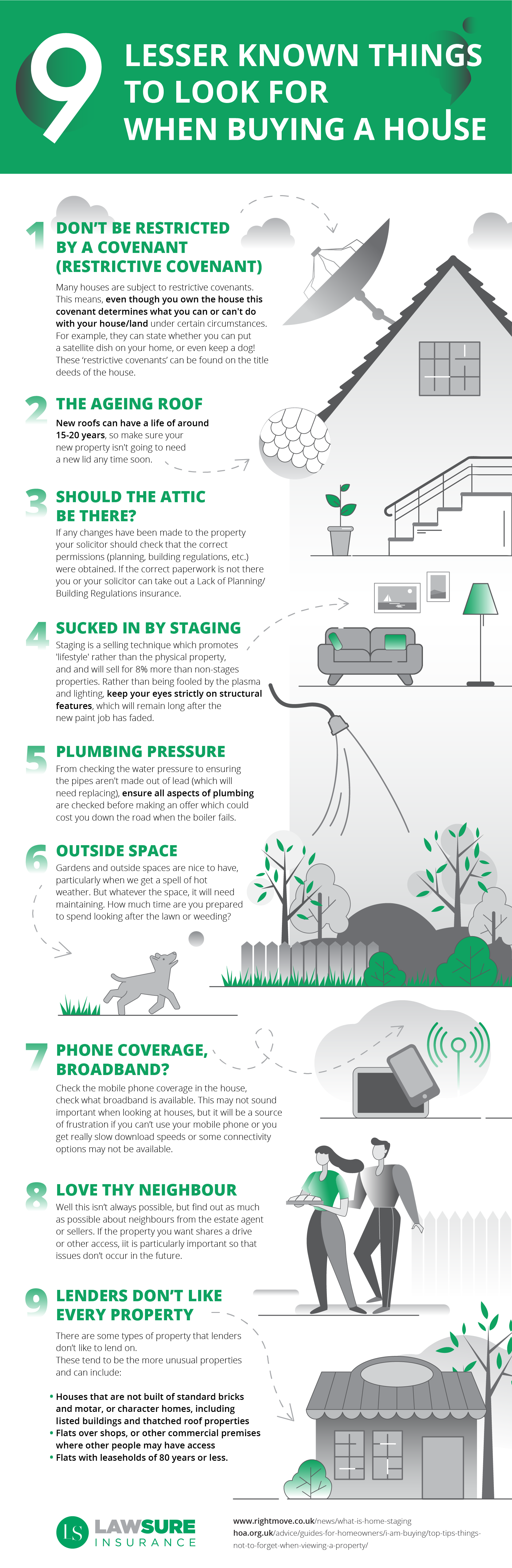

With these tips, purchasing property abroad should always be secure and well-planned. Check out this infographic where they go though buying a house for the first time, restrictive covenants and plumbing when living alone.

[mashshare]

Popular Posts:

Kaya Wittenburg

Kaya Wittenburg is the Founder and CEO of Sky Five Properties. Since the age of 10, real estate has been deeply ingrained into his thoughts. With world-class negotiation and deal-making skills, he brings a highly impactful presence into every transaction that he touches.

He is here to help you use real estate as a vehicle to develop your own personal empire and feel deeply satisfied along the way. If you have an interest in buying, selling or renting property in South Florida, contact Kaya today.